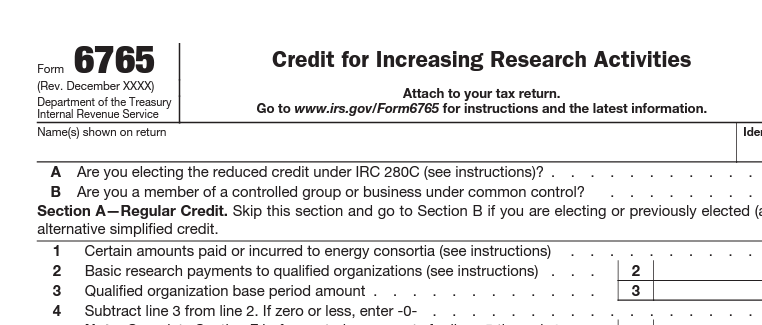

The proposed changes to Form 6765 would increase the qualitative and quantitative information required at the time of filing, thereby increasing the administrative burden and the audit risk associated with claiming the credit.

https://www.irs.gov/pub/irs-utl/form-6765-proposed-changes-fy24.pdf

The IRS proposed 6765 Form Changes to be implemented for Tax Year 2024 are as follows:

Section E includes five questions:

- How many business components (BCs) are in the credit

- Whether officers’ wages were included

- Reporting on any business acquisitions or dispositions

- Identification of new categories of QREs

- Whether the ASC 730 directive was relied upon

Section F gathers information on each of the Business Components, 14 pieces of data:

- EIN of the entity

- Business activity code

- Name of the Business Component

- Information being sought to be discovered

- Whether the Business Component is new or improved (pick one)

- Type of Business Component: product, process, computer software, technique, formula, or invention

- Whether the Business Component is held for sale, lease, license, or business use

- If software, whether it is internal use, dual function (and whether safe harbor was applied), or non-internal use

Cost Per Business Component:

- Amount of direct research wages

- Direct supervision wages

- Direct support wages

- Cost of supplies

- Cost of rented or leased computers

- Amount of contract expenses

The main takeaway: Proposed changes to Form 6765 would substantially change the process for claiming an R&D credit.

Please contact the MASSIE team if you want to discuss this topic further or require assistance with your calculations.

Disclaimer: The information above is subject to change, as the IRS may implement additional guidelines in the future. The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation.