MASSIE answers:

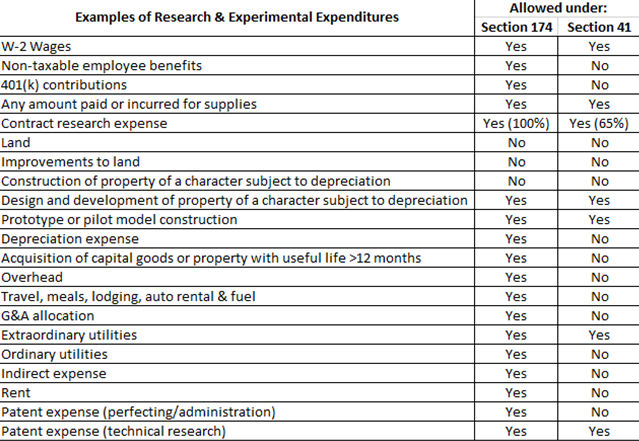

A: The chart below shows some examples of expenditures that may be included as research and experimental expenditures under Section 174 versus Section 41.

Disclaimer: The information above is subject to change, as the IRS may implement additional guidelines in the future. The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation.