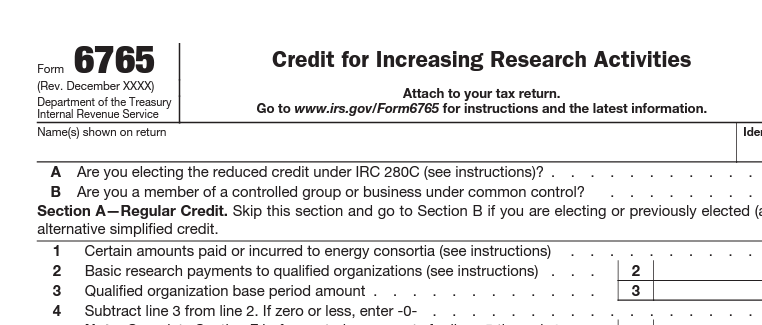

The IRS has proposed significant changes to Form 6765, the key form used to claim the Research and Development (R&D) tax credit. These revisions would increase both the qualitative and quantitative information required at the time of filing. As a result, taxpayers may face greater administrative burden and higher audit risk.

Section E: New Questions for All Taxpayers

The IRS proposes adding five new questions to Section E:

-

How many business components (BCs) are included in the credit?

-

Were officers’ wages included?

-

Were there any business acquisitions or dispositions?

-

Are there new categories of qualified research expenses (QREs)?

-

Was the ASC 730 directive relied upon?

These questions signal a stronger focus on how taxpayers define and support their credit claims.

Section F: Detailed Reporting for Each Business Component

The most substantial changes appear in Section F. Taxpayers would need to provide 14 separate data points for each business component, including:

-

Employer Identification Number (EIN)

-

Business activity code

-

Name of the business component

-

Information being sought to be discovered

-

Whether the component is new or improved

-

Type of component (product, process, software, technique, formula, or invention)

-

Whether it is held for sale, lease, license, or business use

-

For software: whether it is internal use, dual function (and whether safe harbor applies), or non-internal use

Taxpayers would also need to report costs per business component, including:

-

Direct research wages

-

Direct supervision wages

-

Direct support wages

-

Supplies

-

Rented or leased computer costs

-

Contract expenses

What This Means for R&D Tax Credit Claims

The proposed changes would substantially increase the reporting burden for companies claiming the R&D credit. Taxpayers will need more detailed tracking of projects and costs, as well as careful documentation to withstand IRS scrutiny.

While these changes are not yet final, they represent a clear shift in how the IRS expects taxpayers to justify R&D credit claims.

Next Steps

If you want to discuss how these changes could affect your R&D credit claims—or need support preparing for the new reporting requirements—please reach out, we’d love to talk.

Disclaimer: The information above is subject to change, as the IRS may issue additional guidelines. This post is for general informational purposes only and should not be taken as legal advice for any individual situation.