Q: With limited guidance on Section 174, what’s a practical approach to implementing the new rules?

MASSIE answers:

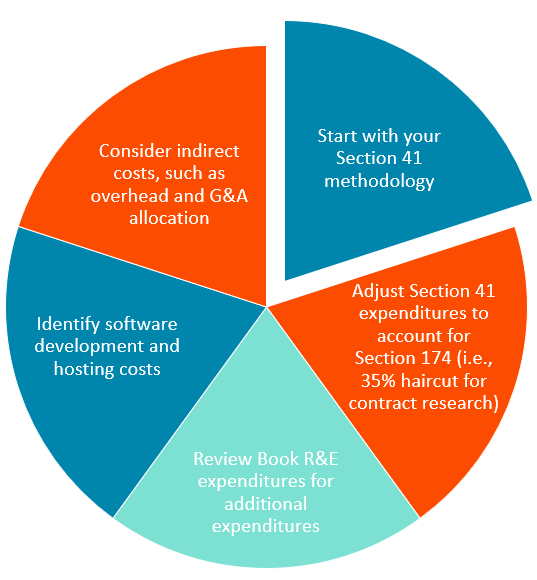

A: Section 174 is a very broad provision and continues to be subjective. To simplify it, think about capturing research and experimental expenditures like casting a net. The net would be much larger for Section 174 research or experimental expenditure than for Section 41 qualified research expenses. The chart below outlines the key components to incorporate Section 174 rules into your process.

Additionally, the IRS recently released two Revenue Procedures related to adopting the new Section 174 rules:

- Rev. Proc. 2023-8: Allows taxpayers to obtain automatic consent in changing the taxpayer’s accounting method to conform to the new Section 174 accounting method provided under the Tax Cuts and Jobs Act.

- Rev. Proc. 2023-11: Removes audit protection for taxpayers adopting the new Section 174 rules if the accounting method change is made after the first tax year Section 174 is effective.

Don’t delay your adoption of the new 174 rules!

Disclaimer: The information above is subject to change, as the IRS may implement additional guidelines in the future. The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation.